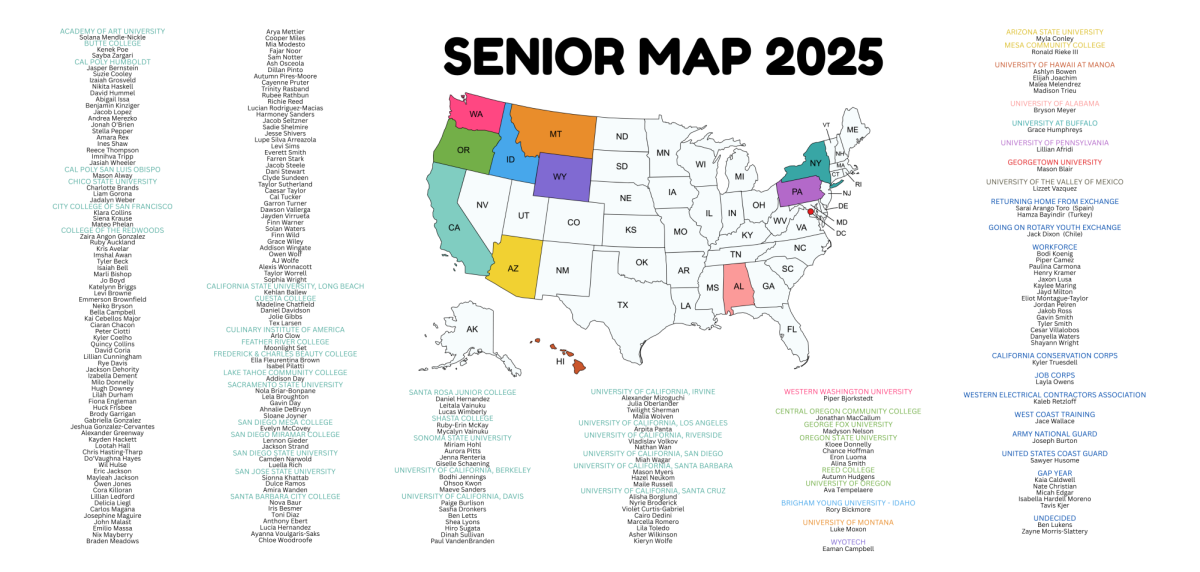

With graduation just around the corner, many seniors are relying heavily on their financial aid packages to make their college decisions.

When applying to colleges, students often overlook the eventual cost that comes with attending these universities. Prospective students see the highlights that each campus offers and tend to narrow down their application decisions based on this information. However, the cost of attending these colleges is very real and can lead seniors to heavily reconsider where they will be attending in the fall.

Arcata High senior Twilight Sherman is in the midst of facing this issue head-on as she receives her aid.

“I got into SDSU, and I’m leaning towards going there because I think I’d like San Diego more, but I’m waiting for my aid package from UC Irvine,” Sherman said. “And if that’s cheaper, then I’ll just go there even though I don’t really want to. And if [the aid] isn’t good, then I might have to stay in Humboldt.”

Financial aid packages can consist of federal funds from the Free Application for Federal Student Aid (FAFSA) or California Dream Act Application (CADAA) for undocumented immigrant students, institutional grants/ awards, and scholarships from third-party donors.

Federal funding is one important factor in a student’s financial aid package, as money from the FAFSA can give students up to $8,000 in Pell Grant money per year that students never have to pay back. The FAFSA can also give students access to federal loans, as these are going to be necessary for some to achieve their educational goals, should it be somewhere they cannot afford out of pocket.

Another source of financial aid comes from educational scholarships. Scholarships can be found nearly everywhere, as donors often want to see students be able to get an education and succeed in order to make a life for themselves. Scholarships can come from schools, community organizations, families, and more, with each often helping a specific demographic of students.

“I got the maximum amount from FAFSA (Pell Grant), and then a state school grant, Cal Grant, and the Middle Class Scholarship from SDSU,” Sherman said. “But the problem is that I would still have to take out more loans, and I don’t know if I really want to do that.”

Even while the seemingly hardest part of getting into college is being granted admission, there is the even more difficult challenge of cost that must be faced before a student can commit to a college. A student may be very interested in attending a university; however, they may not receive much federal or institutional aid and will be unable to afford the big bill that comes with attendance.